The following letter is from the BMXNZ recommended Insurer for Sporting Travel. John & Jose have been supporting BMX riders for years

and know all the ins and outs of sporting travel insurance. If you are travelling to Oceania’s and are still looking for cover, please talk to John & Jose.

Dion,

Further to our conversation this morning the following outlines the comments we discussed.

We explained that arrangements are in some turmoil this year because we no longer have the availability of insurance through Bupa as we have had for many years (in June of last year they announced they were withdrawing from providing travel insurance and this has left a huge gap to fill).

We have made strenuous enquiries to seek alternative arrangements but the only viable option that we have been able to identify is at a much higher premium than previously. Some I know will find the increased premium difficult to accept but it is also essential that any arrangements we recommend are compliant with the regulations in regard to the issue of an international licence for riders so it is a “catch 22” situation.

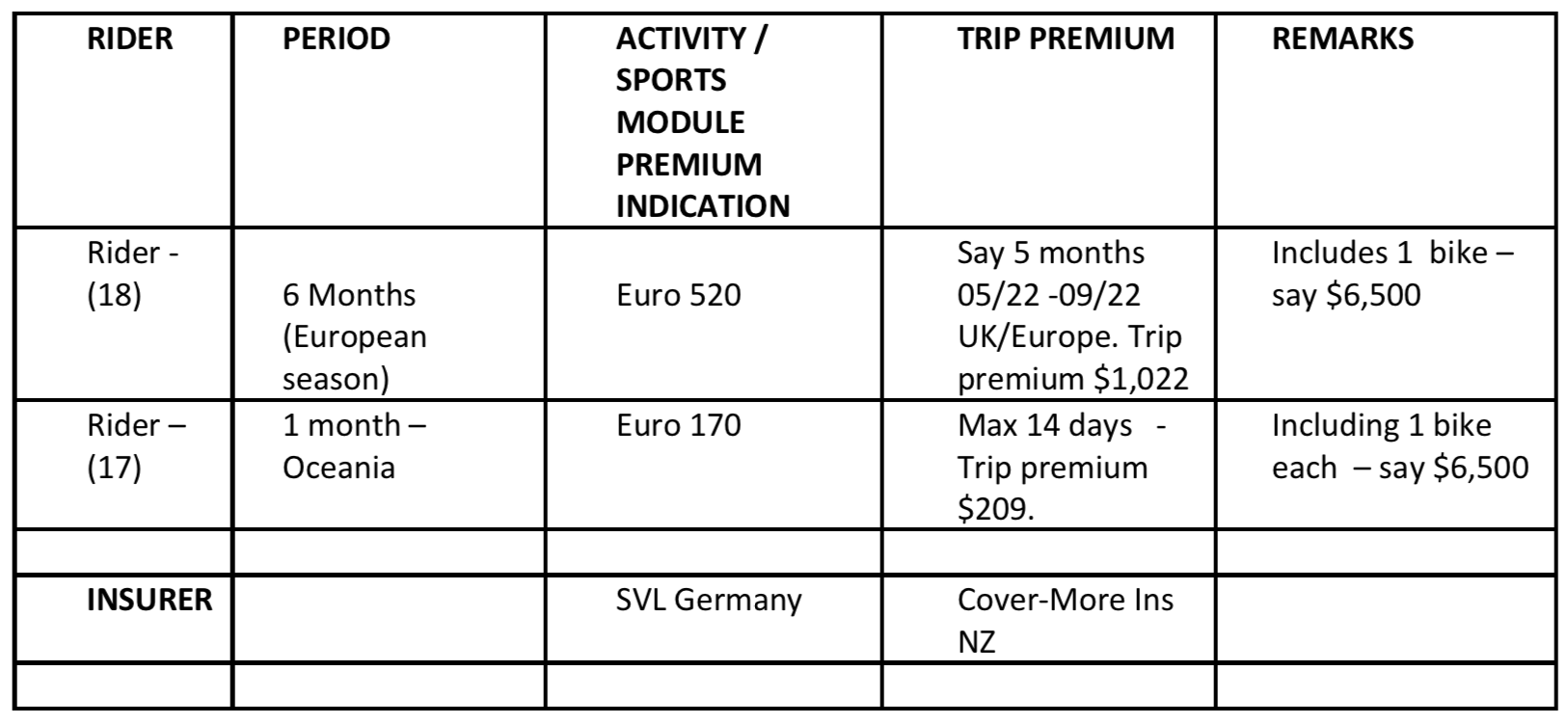

The illustrative Sports Activity Premium for a rider on the basis of:

- Travelperiod–May-September2022

- Traveldestinations-UK,Netherlands,Germany,FranceandthenColombia(taking us into October?)

- Coverage for claims arising from training and competition, the premium will be Euro 240 for 2months cover and Euro 70 per month thereafter.

So for 6 months one is looking at a step up in premium to potentially Euro570. There is an annual premium option of Euro805 – but I doubt this will be necessary for most riders at the stage.

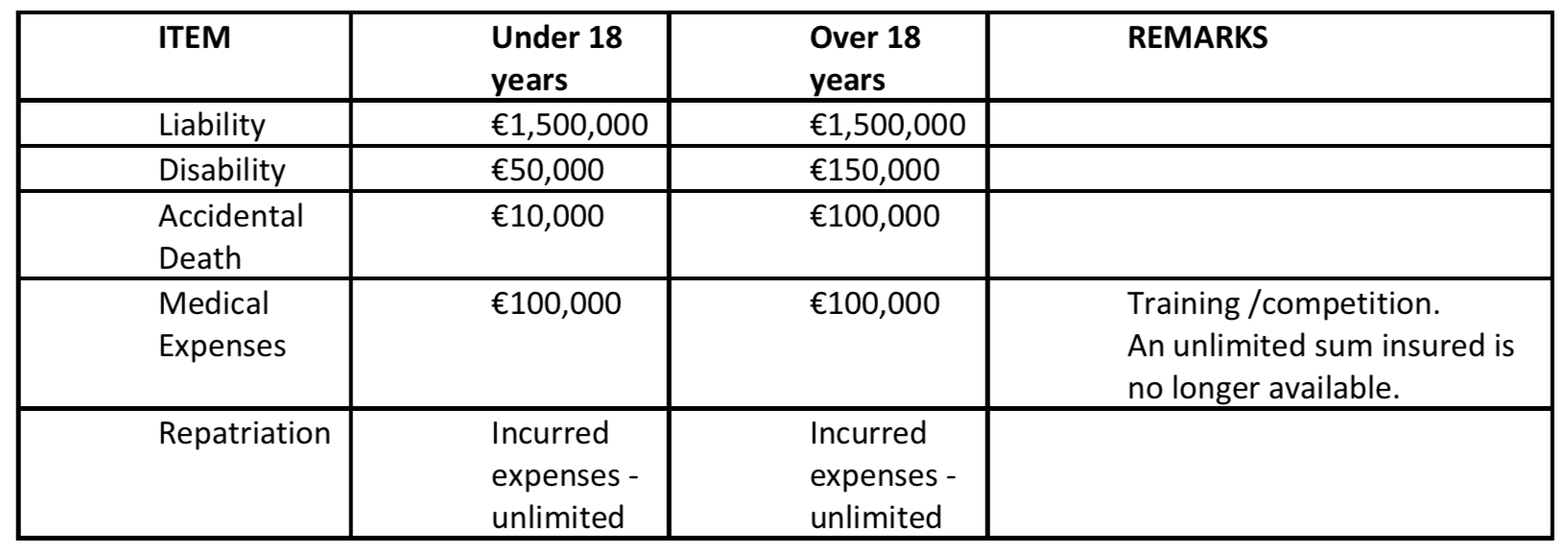

These terms are quoted by SVL Sport Germany GmbH – they are a leading provider of insurance for cycle sports in Europe and importantly the insurance is compliant with the UCI regulations. The benefit levels provided under this arrangements are:

So illustrative premium forecast for the 2022 BMX season is:

The sports activity premium reflects the international claims experience and insurers have rated the risks accordingly. As explained sports codes such as BMX and MTB are recognised as high risk codes. New Zealand riders have had their share of major claims so it is difficult for us to argue for special consideration (some cycling claims that we know of have been in excess of $100k); when claims occur that arise in the overseas locations they have costs structures very different to that which prevails in New Zealand (we are lucky in NZ and of course have the benefit of ACC).

We appreciate this is a different level of premium compared to prior years but it is the best we can do in a very challenging business environment.

A question has been raised with us regarding the comment about ACC being applicable in Australia . My

understanding unless the regulations have changed is:

§ If you are a NZ resident and you return home with an injury that happened overseas, ACC can help cover such costs.

- § ACC usually does not cover overseas treatment costs; and also, they do not cover expenses such as

disrupted travel plans and lost deposits, assisted or emergency travel home, or travel for a relative. These are all aspects that good travel insurance will cover. We know from experience that Ambulance costs can be expensive. - § ThereciprocalagreementbetweenNZandAustraliameansthatNZcitizenstravellingtoAustraliaare eligible for limited subsidised health services for medically necessary treatment whilst visiting Australia. It relates to treatment that is medically necessary occurring in Australia before you return home. The authorities still recommend that NZ travellers take out suitable cover for the period of their travel as reciprocal health care agreements do not replace the need to have private travel health insurance.

- § So–“do not leave home without it”

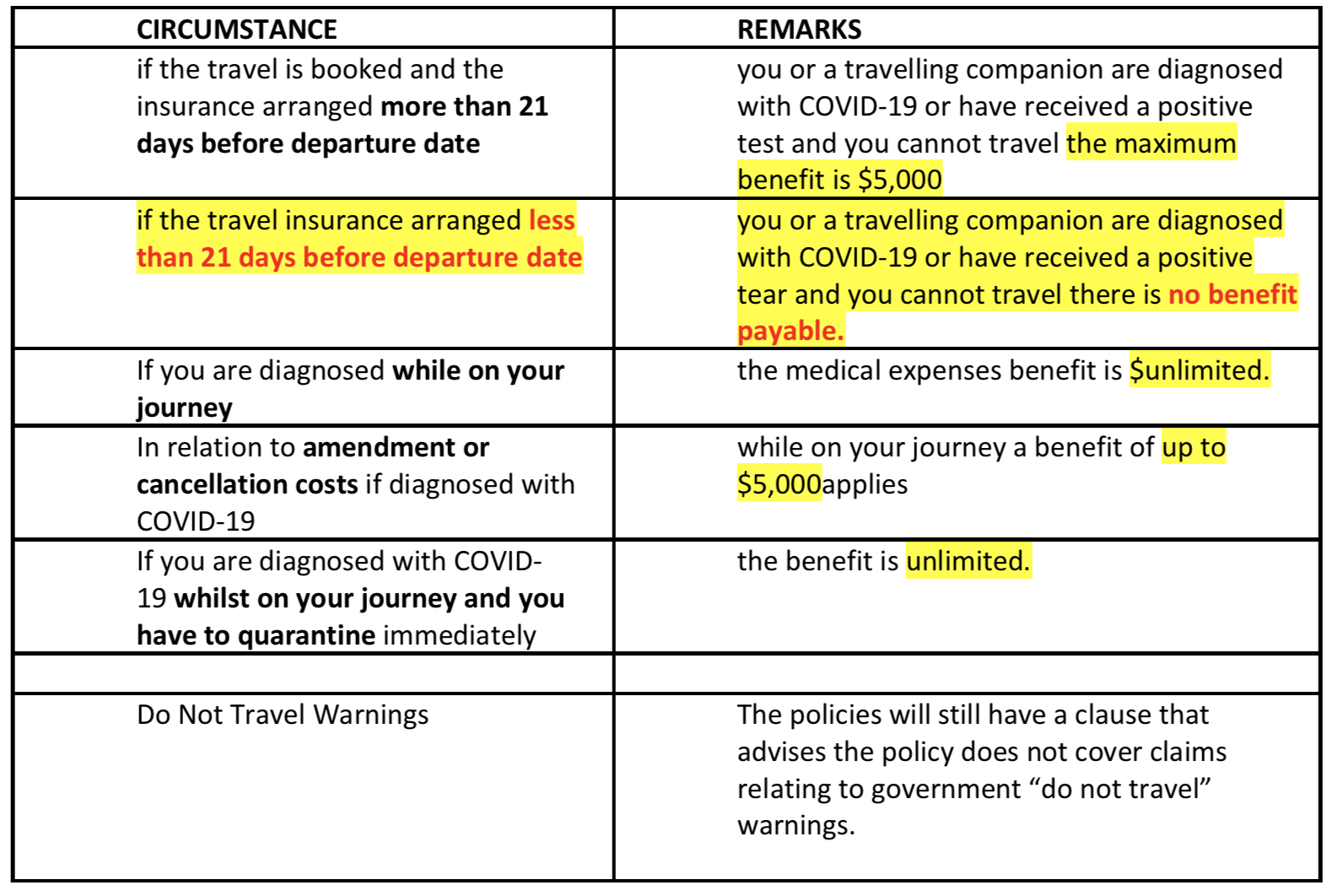

Regarding COVID – insurers beginning to widen the terms of their policies. You mentioned COVER-MORE; they have made the following changes applicable to policies issued after 9th February 2022.

*** Please note If you need General COVID Travel Insurance, due to the 21 day clause noted above, please see Southern Cross Travel Insurance. ****

Should you have any other questions please let me know

Regards Dion